Trade Promotion AI Analytics: Know Which Promotions Actually Made Money

Traditional TPM systems track what ran. AI-powered trade analytics shows what worked, why, and where to shift spend next. CPG teams spend 15-25% of revenue on trade promotion, yet most can't answer basic ROI questions until weeks after events end. Post-event analysis arrives too late to matter. Incrementality calculations vary by analyst. And 60-70% of promotions don't break even—but no one knows which ones until the quarter closes.

What is AI-Powered Trade Promotion Analytics?

Trade promotion analytics is an AI-powered approach that unifies point-of-sale data, syndicated sources, and trade management systems to help CPG commercial teams measure promotion effectiveness and optimize spend allocation.

Unlike Trade Promotion Management (TPM) platforms that track planned versus actual spending but not performance impact, AI-powered trade promotion analytics calculates lift, incrementality, and ROI for every event automatically. It identifies which tactics, retailers, and timing windows drive profitable volume versus volume that would have happened anyway.

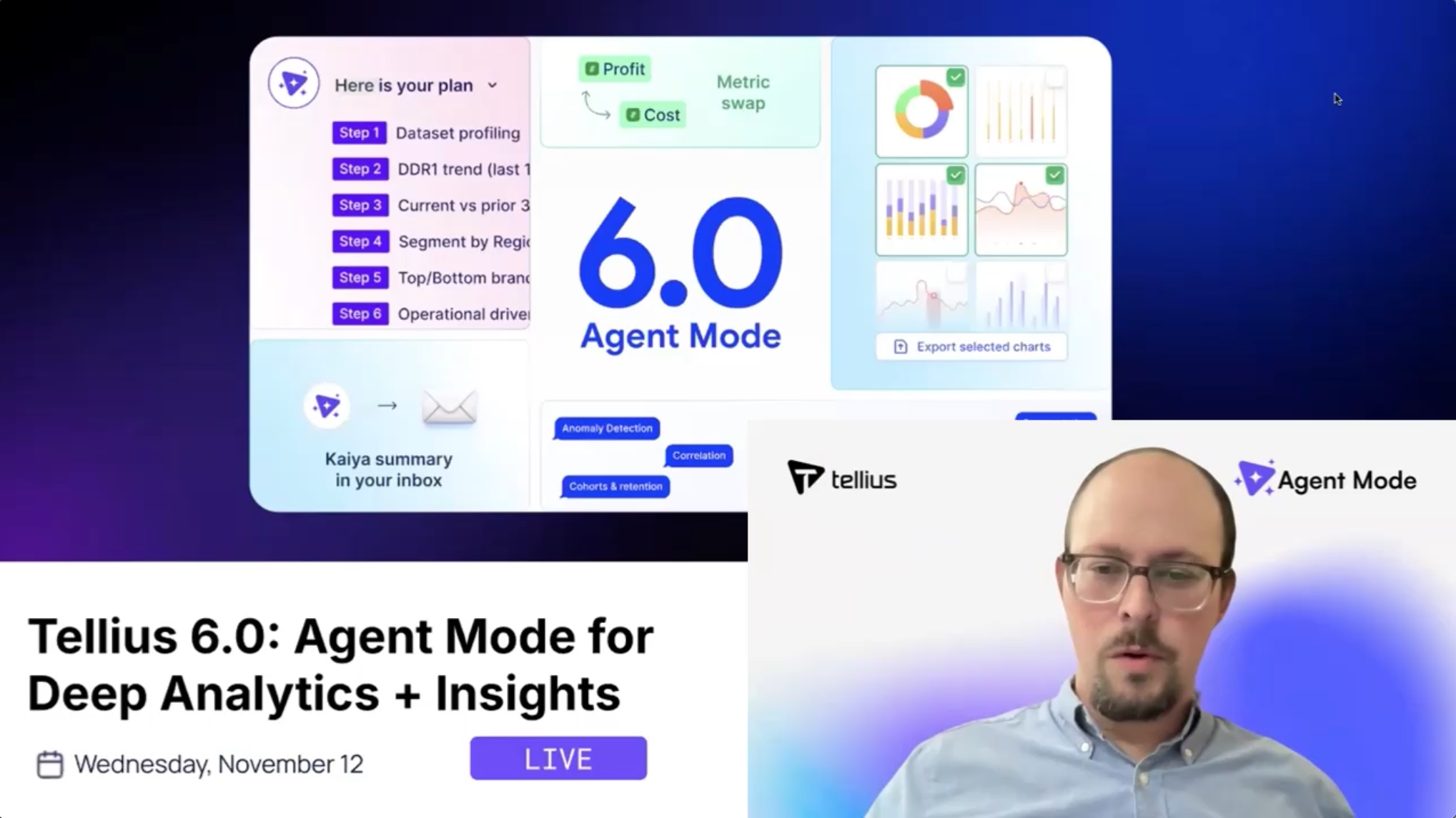

Tellius is a trade promotion analytics platform purpose-built for CPG teams—combining conversational analytics for instant answers with agentic analytics that monitors promotion performance continuously and flags underperforming events while spend reallocation is still possible.

The Problem

You're spending 25% of revenue on trade—and can't prove which half is working

Post-event analysis takes weeks. By then, the money's gone. Incrementality calculations change depending on who runs them. And 60-70% of promotions don't break even—but you won't know which ones until Q4 close.

Why teams can't prove which promotions are working

Promotion Effectiveness is reactive. Post-event analysis takes 2-3 weeks because POS, shipment, and trade spend data require manual reconciliation—by then, the promotion is over and the money is spent.

Promo ROI varies by analyst. No standard methodology means Finance calculates one number, Sales calculates another, and no one trusts either—making it impossible to compare events or optimize spend.

Trade Spend Efficiency is unmeasurable. 60-70% of promotions don't break even, but teams can't identify which ones are losing money until the quarter closes—when reallocation is no longer an option.

Pricing Analytics is disconnected from promo impact. Price changes and promotions are planned separately, so you can't see how discount depth, everyday price, and competitive pricing interact to drive response.

Cannibalization goes unmeasured. Promotions steal volume from other SKUs in your portfolio, but without cross-product analysis, you overstate lift and fund events that move volume from one pocket to another.

Gross-to-Net forecasting ignores promo reality. GTN models use planned trade rates, but actual promotion performance varies wildly—creating forecast misses that surprise Finance every quarter.

How leading brands turn trade spend into measurable ROI

AI-Powered Promotion Effectiveness: Automated lift analysis, incrementality calculation, and base versus promoted volume decomposition within 48 hours of data availability—while reallocation is still possible.

Governed Promo ROI Framework: One consistent calculation for incremental profit versus total cost, applied to every event so comparisons are apples-to-apples and cross-functional debates disappear.

In-Flight Spend Efficiency Monitoring: AI agents flag promotions trending below breakeven while they're still running, enabling mid-quarter reallocation from losers to winners.

Unified Pricing & Promotion Response: Price elasticity and promotion lift modeled together, showing how depth, timing, and base price combine to affect consumer behavior.

Cannibalization & Halo Quantification: AI measures how each promotion affects the full portfolio—separating true incremental gains from internal volume shifts and identifying positive halo effects.

Promo-Informed Gross-to-Net: Actual promotion effectiveness feeds GTN calculations, replacing assumed trade rates with measured performance for accurate revenue forecasting.

The results

The ROI of knowing which promotions work

15

%+

48

hours

70%+

$50M+

Why tellius

How AI Transforms Trade Promotion Analytics

Unify

Connect POS data (Nielsen, Circana), retailer data (Walmart Luminate, Kroger 84.51°), shipment data, and trade spend from TPM systems into one governed layer. Match events to outcomes automatically.

Explain

AI calculates lift, incrementality, and ROI for every promotion. Root cause analysis shows why events over- or under-performed—separating execution issues from tactic problems from market conditions.

Act

Agentic workflows monitor in-flight promotions against expectations, flag events trending below breakeven, and generate reallocation recommendations while spend decisions can still be changed.

Questions & Answers

Real Questions from CPG Analytics Teams

Part 1: Trade Promotion Fundamentals

Understand what trade promotion analytics is, why it matters, and what problems it solves.

1. What is trade promotion analytics and how does AI change it?

Trade Promotion Management (TPM) systems handle the operational side of promotions: planning events, managing funds, tracking deductions, and reconciling what was spent against what was planned. They answer "Did we execute the promotion we planned?" and "Did we spend what we budgeted?"

Trade promotion analytics answers the next question: "Did it work?" It measures the actual performance impact of promotions—calculating lift (how much sales increased), incrementality (how much of that increase wouldn't have happened without the promotion), and ROI (whether the incremental profit exceeded the cost). TPM tells you what ran. Trade promotion analytics tells you what worked.

AI changes trade promotion analytics in three fundamental ways. First, it automates data integration across POS, syndicated, TPM, and shipment sources—eliminating weeks of manual reconciliation. Second, AI-powered baseline models calculate what would have sold without promotion consistently across every event, eliminating analyst-dependent variation. Third, agentic AI monitors promotions in-flight and flags underperformers while reallocation is still possible.

Most CPG companies have TPM systems but lack the analytics layer that connects promotion activity to business outcomes. This is why teams can tell you exactly how much they spent on a Walmart BOGO but can't tell you whether that BOGO made or lost money.

2. Why do CPG companies struggle to measure trade promotion effectiveness?

The struggle comes from three structural problems. First, data fragmentation: POS data lives in syndicated sources like Nielsen or Circana, shipment data lives in ERP systems, trade spend lives in TPM systems, and retailer-specific data lives in portals like Walmart Luminate. Each system uses different product hierarchies, time periods, and event definitions.

Second, baseline complexity: calculating what would have sold without the promotion requires sophisticated modeling that accounts for seasonality, trends, competitive activity, and cannibalization from other products in your portfolio. Different analysts using different assumptions get different answers.

Third, timing: by the time all data is available, reconciled, and analyzed, the promotion ended weeks ago. The insights arrive too late to change anything about that event, and often too late to inform the next planning cycle.

3. Why do 60-70% of trade promotions fail to break even?

Industry research consistently shows that most trade promotions destroy value rather than create it. The math is straightforward: promotions drive volume, but much of that volume is non-incremental—consumers who would have bought anyway just stocking up at a lower price, or purchases pulled forward from future periods. When you subtract the baseline (what would have sold anyway), factor in the margin you gave up on the discounted units, and add the fixed costs of execution, most events don't generate enough incremental profit to cover the investment.

The problem compounds because teams can't see this at the individual event level. Without granular ROI visibility, bad promotions get repeated quarter after quarter because they "drove volume"—even though they drove it at a loss. Breaking this cycle requires measuring every event against a consistent incrementality standard.

4. What does "trade spend optimization" actually mean in practice?

Trade spend optimization means allocating your promotion budget to maximize incremental profit rather than volume. In practice, this involves several shifts. First, moving spend from low-ROI tactics to high-ROI tactics—if temporary price reductions (TPR) generate 20% ROI and buy-one-get-one (BOGO) generates 5%, shifting budget toward TPR improves overall returns.

Second, reallocating across retailers based on responsiveness—some retailer/product combinations show strong promotion response while others don't, and directing spend toward responsive combinations improves efficiency.

Third, timing optimization—understanding seasonality and competitive windows to run promotions when consumers are most responsive.

The challenge is that optimization requires accurate, granular measurement at the event level, which most companies lack. Without knowing which specific promotions worked, you can't systematically improve.

5. How long does post-event analysis typically take without AI?

Most CPG companies report post-event analysis cycles of 2-4 weeks from when data becomes available to when insights reach decision-makers. The process involves pulling POS data from syndicated providers (which itself arrives 1-2 weeks after the fact), matching it to the correct promotion events in the trade system, pulling shipment and inventory data, normalizing everything to common hierarchies, running baseline calculations, computing lift and ROI, validating results, and building reports.

Each step involves manual work, often in Excel. Analysts spend more time preparing data than analyzing it. By the time results are ready, the promotion ended a month ago, the next planning cycle has already started, and the insights become historical trivia rather than actionable input.

6. What's the relationship between trade promotion analytics and Revenue Growth Management?

Revenue Growth Management (RGM) is the broader discipline of optimizing pricing, promotion, assortment, and mix to drive profitable growth. Trade promotion analytics is a critical component of RGM—it provides the measurement foundation that tells you whether your promotional investments are creating value.

Without trade promotion analytics, RGM becomes guesswork. You can model pricing elasticities and recommend promotion depths, but you can't validate whether your recommendations actually worked. Many RGM programs stall because they lack the post-event measurement capability to prove (or disprove) their recommendations.

Advanced organizations use trade promotion analytics as the feedback loop that continuously improves RGM models—comparing predicted lift to actual lift, identifying where models are accurate versus off-base, and refining recommendations over time.

7. Who uses trade promotion analytics and what decisions does it inform?

Trade promotion analytics serves multiple stakeholders with different questions. Revenue Growth Managers use it to optimize promotion mix, depth, and timing across the portfolio. Sales and Key Account Managers use it to prepare for retailer Joint Business Planning (JBP) meetings with fact-based performance data. Trade Marketing uses it to evaluate tactic effectiveness and plan future calendars. Finance uses it to understand trade ROI and forecast gross-to-net. Category Managers use it to assess how promotions interact with assortment and shelf strategy.

The common thread is that all these roles need to know "Did it work?" and "What should we do differently?" Trade promotion analytics provides the measurement foundation for those answers.

8. What data sources feed trade promotion analytics?

Effective trade promotion analytics requires four categories of data. First, point-of-sale (POS) data from syndicated providers like Nielsen or Circana, or direct retailer feeds like Walmart Luminate, Kroger 84.51°, or Target Roundel—this shows what actually sold at what price and whether promotions were active.

Second, trade spend and event data from TPM systems like SAP TPM, Exceedra, or Anaplan—this shows what promotions were planned, what tactics were used, and what was spent.

Third, shipment and inventory data from ERP systems—this helps validate sell-through and identify execution gaps where promotions didn't make it to shelf.

Fourth, market and competitive data from syndicated sources—this provides context on category trends, competitor activity, and share movements that affect baseline calculations.

The integration challenge is that these sources use different product hierarchies, time periods, and geographic definitions that must be harmonized before analysis.

Part 2: Measurement, Incrementality & ROI

Deep dive into how promotion performance is calculated, what metrics matter, and how to interpret results.

9. What's the difference between lift and incrementality, and how does AI measure them?

Lift measures total sales increase during a promotion compared to a baseline period—if baseline sales are 100 units and promotion sales are 150 units, lift is 50%. But lift overstates promotion effectiveness because it includes volume that would have happened anyway.

Incrementality isolates the portion of sales truly caused by the promotion. It accounts for baseline sales that would have occurred without the promotion, pull-forward effects where consumers buy earlier than they would have, pantry-loading where consumers stockpile and buy less in subsequent periods, and cannibalization from other products in your portfolio.

True incrementality is typically 40-60% of measured lift. A promotion showing 50% lift might deliver only 20-30% incremental volume when these adjustments are applied. ROI calculations based on lift rather than incrementality dramatically overstate promotion value.

AI measures both by building sophisticated baseline models that learn from thousands of historical item-store-week combinations, automatically accounting for seasonality, trends, competitive activity, and cross-product effects—then applying these adjustments consistently across every event.

10. Can AI automate baseline calculation for trade promotions?

Yes, and this is one of the highest-value applications of AI in trade promotion analytics. Traditional baseline calculation requires analysts to manually identify comparable non-promoted periods, adjust for seasonality and trends, account for competitive activity, and make judgment calls about anomalies. Different analysts make different assumptions and get different baselines.

AI-powered baseline models learn patterns from historical data across thousands of item-store-week combinations. They automatically account for seasonality, trends, holiday effects, competitive promotions, weather, and other factors that affect "normal" sales. More importantly, they apply these adjustments consistently across every event, eliminating the analyst-to-analyst variation that makes traditional baselines unreliable.

The result is defensible, consistent baselines that Finance, Sales, and Marketing can all trust—eliminating the "my spreadsheet versus your spreadsheet" debates.

11. How does AI calculate trade promotion ROI?

AI calculates trade promotion ROI by measuring incremental profit generated versus total promotion cost. The formula is (Incremental Revenue × Margin - Promotion Cost) / Promotion Cost—but each component requires sophisticated calculation.

Incremental revenue comes from AI-powered baseline models that isolate truly incremental volume from volume that would have occurred anyway. Margin reflects the actual margin on promoted volume, including any trade rate or off-invoice discounts. Promotion cost includes all fixed and variable costs: scan allowances, display fees, ad co-op, slotting fees, and internal execution costs.

AI ensures consistency by applying the same methodology to every event automatically. When Finance asks "What was ROI on the Walmart BOGO?" and Sales asks the same question, they get the same answer—because AI calculated it the same way both times.

Many companies overstate ROI by using lift instead of incrementality, or understate costs by excluding certain line items. AI-powered analytics applies consistent methodology across all events, enabling apples-to-apples comparison to identify winners and losers.

12. How do I know if my incrementality calculations are accurate?

Incrementality accuracy can be validated several ways. Holdout testing provides the gold standard: run a promotion in some stores but not others, then compare sales in promoted versus control stores to measure true lift. This eliminates baseline assumptions entirely, though it's operationally complex and retailers often resist withholding promotions.

Model validation compares predicted baseline to actual sales during non-promoted periods—if the model accurately predicts "normal" sales when no promotion is running, you can trust its baseline estimates during promoted periods.

Cross-validation with shipment data confirms that sell-through patterns match POS data—if POS shows a big lift but retailer inventory didn't actually move, something is wrong.

Finally, pattern consistency matters: incrementality estimates should show logical patterns where deeper discounts drive more incrementality, and results should be stable over time absent major market changes.

13. How do I compare promotion ROI across different retailers?

Retailer comparison requires normalizing several factors. First, ensure costs are captured completely—some retailers charge more in fixed fees while others take larger trade rates, and incomplete cost capture distorts comparison.

Second, control for baseline differences—a 10% lift at a retailer with high baseline velocity generates more incremental volume than 10% lift at a low-velocity retailer.

Third, consider cannibalization across retailers—a promotion at one retailer may steal volume from another, meaning your "incremental" sales at the promoted retailer are partially offset by losses elsewhere.

Fourth, factor in strategic value beyond pure ROI—a breakeven promotion at a must-win retailer may be worth more than a positive-ROI promotion at a marginal account.

The goal is consistent methodology so you can rank retailer performance fairly, while acknowledging that ROI alone doesn't capture full strategic value.

14. Can AI recommend optimal promotion mix?

AI can analyze historical promotion performance to identify which tactics, discount depths, timing windows, and retailer combinations have generated the best ROI—and use those patterns to recommend future promotion plans.

The recommendations typically include tactic selection (TPR versus BOGO versus display-only), discount depth (10% off versus 20% off versus buy-one-get-one), timing (which weeks show highest response), retailer allocation (where to concentrate versus reduce spend), and product selection (which SKUs respond best to promotion).

The key constraint is that AI can only recommend based on what you've tried before. If you've never run a specific tactic at a specific retailer, there's no historical data to learn from. Sophisticated systems use transfer learning to estimate performance for untried combinations based on similar situations.

15. How does AI identify which promotions to cut?

AI identifies promotions to cut by ranking all events by ROI using consistent methodology, then analyzing why low performers underperformed. The bottom tier—events with negative ROI—are immediate candidates for elimination or restructuring.

AI goes beyond simple ranking to diagnose root causes. It distinguishes between execution failures (out-of-stocks, display non-compliance) that can be fixed and structural problems (low-margin products, weak consumer response to discounts) that require different tactics or elimination.

AI also flags patterns across events: if BOGO consistently underperforms TPR at a specific retailer, that's a tactic problem. If all promotions underperform at a specific retailer, that's an account problem. If promotions on certain products always lose money, that's a product problem.

This diagnostic capability enables smarter decisions—fixing what can be fixed, cutting what can't, and understanding why so the same mistakes don't repeat.

16. How do I measure the impact of display and feature support on promotion effectiveness?

Display and feature (shelf merchandising, ad circular inclusion, end-cap placement) can dramatically amplify promotion impact—or fail to materialize despite being planned. Measuring this impact requires tracking execution compliance and correlating it with lift.

Execution tracking captures whether displays were actually set up, whether products were featured as planned, and whether merchandising conditions matched what was promised. Retail audit data, store-level photos, and retailer compliance reports provide this visibility.

The analysis then compares lift when execution was compliant versus when it wasn't. If promotions with display support show 3x the lift of promotions without, that quantifies display value. This informs both planning (budget more for display-supported events) and accountability (hold retailers to execution commitments).

17. How do pricing decisions interact with promotion effectiveness?

Pricing and promotions are often planned separately, but they interact in ways that dramatically affect results. A 20% discount from a $5.99 everyday price generates different consumer response than 20% off $6.49—even though the promoted price is similar.

Price elasticity modeling shows how consumers respond to price changes at different base price levels. Promotion response modeling shows how discount depth affects lift. Combining these reveals optimal pricing and promotion combinations: the everyday price that maximizes margin while maintaining promotion responsiveness.

Tellius unifies pricing analytics and promotion analytics in one platform, so Revenue Growth Managers can see how base price, competitive price gaps, and discount depth combine to drive consumer behavior—rather than optimizing each in isolation.

18. How does AI measure cannibalization from trade promotions?

Cannibalization occurs when a promotion on one SKU steals volume from other products in your portfolio—making the "incremental" volume less valuable than it appears. A BOGO on your 12-oz size may pull volume from your 24-oz size, not from competitors.

AI measures cannibalization by analyzing how promotions on one product affect sales of related products—same brand different size, same category different brand, adjacent categories. The calculation compares portfolio-level lift to promoted-item lift: if the promoted item shows 50% lift but the portfolio only shows 30%, the difference is cannibalization.

AI also identifies halo effects—where some promotions drive trial that lifts related products. By quantifying both cannibalization (negative spillover) and halo (positive spillover) across your full portfolio, AI gives you true net incrementality rather than overstated single-item lift.

This portfolio-level view is impossible with manual analysis but straightforward for AI analyzing thousands of item-store-week combinations simultaneously.

19. How does AI-powered trade analytics connect to gross-to-net forecasting?

Gross-to-net (GTN) forecasting estimates how much of your gross revenue will survive deductions for trade spend, rebates, chargebacks, and other adjustments. The trade promotion component is often the most volatile—and the hardest to forecast accurately.

Traditional GTN models use planned trade rates, but actual promotion performance varies wildly by event. A promotion planned at 15% trade rate may deliver 8% incremental volume at Retailer A and 22% at Retailer B—making the "average" rate meaningless for forecasting.

AI-powered trade promotion analytics provides actual promotion effectiveness data that feeds more accurate GTN models. Instead of assuming trade rates based on plans, you use measured performance: which promotions delivered, which didn't, and how that maps to expected revenue realization.

This reduces the GTN forecast variance that surprises Finance every quarter—replacing assumptions with AI-measured reality.

Part 3: Platform Evaluation & Implementation

Evaluate trade analytics platforms, understand implementation, and build the business case.

20. What's the typical implementation timeline for trade promotion analytics?

Implementation typically takes 8-14 weeks depending on data complexity and scope. Weeks 1-3 involve data integration: connecting POS data feeds (Nielsen, Circana, or retailer-direct), trade spend and event data from TPM systems, and shipment data from ERP. This phase establishes the data pipelines and harmonizes product hierarchies.

Weeks 4-7 focus on baseline modeling and validation: building the AI models that calculate expected sales without promotion, then validating those baselines against historical non-promoted periods to ensure accuracy.

Weeks 8-10 cover ROI framework configuration: defining how lift, incrementality, and ROI will be calculated, ensuring Finance and Commercial agree on methodology.

Weeks 11-14 involve user training, report deployment, and workflow integration: making sure the insights reach the people who need them in formats they can act on.

First value—seeing initial promotion results—typically arrives around week 6-8. Full deployment with validated models takes 12-14 weeks.

21. What ROI should we expect from trade promotion analytics?

ROI comes from three primary sources. First, direct trade spend improvement: shifting 10-15% of spend from low-ROI to high-ROI promotions typically generates 1-3% improvement in overall trade ROI—on a $300M trade budget, that's $3-9M in additional incremental profit annually.

Second, time savings: automating post-event analysis saves 2-3 weeks per event cycle. For a team running 50+ major events per year, that's hundreds of analyst hours redirected from data preparation to value-add analysis.

Third, negotiation leverage: walking into JBP meetings with fact-based promotion performance by retailer strengthens your position. Knowing exactly which promotions worked (and which didn't) at each retailer changes the conversation.

Most organizations see payback within 6-12 months. The business case is often most compelling when framed as "cost of not knowing"—the ongoing waste from ineffective promotions that repeat quarter after quarter.

22. How do I build a business case for trade promotion analytics?

Start with the size of the problem: what's your total trade spend, and what percentage of promotions do you suspect don't break even? Industry benchmarks suggest 60-70% underperform, but even conservative estimates create a large addressable opportunity.

Quantify the "cost of not knowing": without event-level ROI visibility, bad promotions repeat. If 10% of trade spend ($30M on a $300M budget) goes to consistently negative-ROI events, that's the annual waste target.

Add time value: calculate analyst hours spent on manual post-event analysis, multiply by fully-loaded cost. If you're spending 200+ hours per month on trade analysis that could be automated, that's significant.

Include strategic value: better retailer conversations, faster decisions, competitive advantage from superior trade execution.

Frame implementation cost against these benefits. Trade promotion analytics platforms typically show 5-10x ROI when all value drivers are included.

23. How does trade promotion analytics integrate with existing TPM systems?

Trade promotion analytics sits alongside TPM rather than replacing it. TPM remains the system of record for promotion planning, fund management, and deduction processing. Trade promotion analytics adds the measurement layer that TPM lacks.

Integration typically works through data feeds: event and spend data flow from TPM into the analytics platform, which combines it with POS and other sources to calculate performance. Results can flow back into TPM as event-level performance metrics that enhance the planning interface.

The goal is complementary value, not replacement. Teams continue using TPM for operational workflows while gaining performance measurement they didn't have before. Some organizations display analytics results directly in the TPM interface; others use separate dashboards for analysis while TPM handles execution.

24. What questions can a Revenue Growth Manager ask in plain English about trade performance?

Revenue Growth Managers can query conversationally across the full spectrum of trade analytics: "What was the ROI on last month's Walmart promotions?", "Which BOGO events are underperforming versus plan this quarter?", "Show me promotions where lift exceeded 30% and tell me what they have in common", "How does Kroger promotional effectiveness compare to Target for the beverage category?", "Which events have the worst ROI and should we consider cutting?"

The semantic layer understands trade vocabulary—TPR, BOGO, FSI, lift, incrementality, trade rate—so queries don't require technical translation. This shifts RGMs from waiting for analyst reports to self-serving answers during planning meetings, retailer calls, and strategy sessions.

The difference between "I need to ask an analyst to pull that" and "Let me check right now" is often the difference between a decision made on data and a decision made on instinct.

25. What is the best AI-powered trade promotion analytics platform for CPG companies?

The best AI-powered trade promotion analytics platform for CPG needs five capabilities most platforms lack.

First, multi-source data integration: the platform must connect syndicated POS data (Nielsen, Circana), retailer-direct data (Walmart Luminate, Kroger 84.51°), TPM event data, and shipment data without requiring extensive custom integration work.

Second, automated baseline modeling: AI-powered baseline calculation that accounts for seasonality, trends, and competitive activity consistently across all events—eliminating analyst-dependent variation.

Third, granular ROI at scale: the ability to calculate lift, incrementality, and ROI for individual events across thousands of item-store-week combinations, not just aggregate portfolio views.

Fourth, conversational analytics: business users should be able to ask "What was ROI on Q3 Walmart promotions?" in plain English and get instant answers without waiting for analyst reports.

Fifth, agentic monitoring: AI agents that track in-flight promotion performance against expectations and flag underperforming events while spend reallocation is still possible.

Tellius is purpose-built for CPG trade promotion analytics and delivers all five capabilities. It deploys in 8-14 weeks on existing data infrastructure.

26. How is trade promotion analytics different from Trade Promotion Optimization (TPO) vendors?

Trade Promotion Optimization (TPO) vendors focus on prediction and planning: they model expected promotion response and recommend future event plans. Trade promotion analytics focuses on measurement: it calculates what actually happened and why.

In practice, you need both. TPO without measurement is guesswork—you're optimizing based on models that may or may not reflect reality. Measurement without optimization is incomplete—you know what worked but lack systematic planning improvement.

Some TPO vendors include measurement capabilities; some trade analytics platforms include optimization. The key question is whether measurement is rigorous (consistent baselines, true incrementality) or an afterthought. Many TPO solutions prioritize planning sophistication over measurement accuracy, leading to plans that look optimal but can't be validated.

Tellius focuses on measurement with sufficient planning insight to inform decisions—recognizing that accurate measurement is the foundation optimization depends on.

27. What questions should we ask vendors when evaluating trade promotion analytics platforms?

Data integration: Can you connect Nielsen/Circana syndicated data, retailer-direct feeds, and TPM systems? How do you handle product hierarchy differences across sources?

Baseline methodology: How do you calculate baselines? Is it consistent across all events or analyst-dependent? How do you account for seasonality, trends, and competitive activity?

Incrementality: Do you calculate true incrementality or just lift? How do you account for pantry loading, pull-forward, and cannibalization?

Granularity: Can you calculate ROI for individual events at item-retailer level, or only aggregate views?

User experience: Can business users ask questions in plain English, or do they need analysts to build reports?

In-flight visibility: Can you flag underperforming promotions while they're still running, or only after events end?

Vendors who answer with CPG-specific examples—specific retailers, specific data sources, specific results—are worth serious consideration.

28. What is the best AI platform for trade promotion analytics?

The best AI platform for trade promotion analytics combines measurement, optimization, and planning capabilities in one integrated solution.

For ROI Measurement: AI-powered baseline modeling calculates expected sales without promotion consistently across every event—eliminating analyst variation. Pre-built CPG connectors pull cost data from TPM systems, syndicated sources, and retailer feeds into one governed layer. Configurable ROI frameworks let Finance and Commercial agree on methodology once, then apply it automatically.

For Spend Optimization: Granular ROI at the event level—not just portfolio averages—shows which specific promotions at which retailers drove profit. Machine learning identifies patterns in what drives success: which tactics, discount depths, timing windows, and product/retailer combinations generate the best returns. Agentic workflows flag in-flight promotions trending below expectations, enabling reallocation while money isn't yet spent.

For Promotion Planning: Scenario planning grounded in measured results uses your actual promotion history to model "what if" questions. When you model "What if we shift 20% of BOGO spend to TPR at Walmart?", response rates come from your own data—not industry averages or consultant assumptions.

Tellius delivers all three capabilities—measurement accuracy first, then optimization and planning built on that foundation. The result is ROI numbers that Finance, Sales, and Marketing all trust—because they're calculated the same way every time.

29. How does Tellius compare to building trade analytics on Snowflake or Databricks?

You can build trade promotion analytics capabilities on your data platform, but expect 9-18 months before teams can actually use it.

Custom builds require: integrating syndicated POS data, retailer data, TPM data, and shipment data with product hierarchy harmonization; building baseline models that account for seasonality, trends, and competitive activity; creating ROI calculation frameworks with governance around methodology; developing user interfaces that non-technical users can actually navigate; and maintaining all of this as data sources and business requirements change.

Tellius provides pre-built CPG connectors, validated baseline modeling, governed ROI frameworks, and conversational interfaces—deployed in 8-14 weeks instead of 9-18 months. It runs on your existing Snowflake or Databricks infrastructure, so you get the speed of a purpose-built platform without moving your data.

Build if you have dedicated data engineering resources and 18+ months runway. Buy Tellius if you need trade promotion visibility this year.

30. What skills does my team need to use trade promotion analytics?

Modern AI-powered platforms are designed for business users rather than data scientists. Revenue Growth Managers, Trade Marketing Managers, and Key Account Managers should be able to ask questions like "What was the ROI on last month's Walmart promotions?" and get instant answers without writing code or building reports.

That said, you'll benefit from having someone who can configure the system, define business rules, and validate results—typically a Revenue Management Analyst or similar role with comfort in both the business and data sides.

The shift from traditional analytics is significant: instead of analysts spending 80% of time preparing data and 20% analyzing, AI handles the preparation and users focus entirely on insights and decisions.

31. What data do I need and how do I validate trade analytics results?

Three data elements are the minimum viable dataset for promotion ROI: (1) POS data covering the promotional period—either syndicated weekly data or retailer daily data for the promoted account, (2) promotion event definition—which products, which stores/markets, which dates, what tactic, (3) trade spend for the event—total cost including scan allowances, display fees, and any associated costs.

With these three elements, you can calculate baseline, lift, and ROI. Advanced capabilities (incrementality adjustment, cannibalization measurement) require additional data but aren't prerequisites for getting started. The first insight is often sobering—seeing actual ROI for events you assumed were successful.

Validation Approaches:

Validation happens at three levels. First, baseline validation: compare model-predicted baselines to actual sales during non-promoted periods. If the model accurately predicts "normal" sales, you can trust its promoted-period baselines.

Second, shipment reconciliation: confirm that POS-measured lift patterns align with actual product movement. If POS shows big lift but inventory didn't move, investigate data quality.

Third, face validity with business experts: do results align with what experienced trade managers know from the field? If analytics says a promotion worked but the sales team knows execution was terrible, investigate the disconnect.

Ongoing validation includes holdout testing where feasible (running promotions in some stores but not others to measure true lift) and continuous monitoring for results that seem implausible.

"We spent years arguing about which promotions worked. Now we have one number everyone trusts. The debates are over—we focus on what to do next instead of whose spreadsheet is right."

Stop Funding Promotions That Lose Money

Trade promotion is your biggest controllable expense. See which events actually drive profit—before the quarter ends.

The Challenge Every Pharma Commercial Leader Faces

You're drowning in data from IQVIA, claims databases, CRM systems, and competitive intelligence platforms—yet when executives ask "Why did our numbers change?" the answer is always: "We'll need a few days to investigate."

The Problem Isn't Lack of Data — It's Lack of Insights

Traditional dashboards show what happened, not why

Root cause analysis takes days or weeks of manual investigation

Non-technical users can't explore data without submitting IT requests

Insights arrive too late to prevent revenue loss

Multiple tools and data sources create fragmented views

Field teams spend 40% of their time preparing reports instead of selling

Agentic Analytics Changes Everything

Deploy AI agents that work 24/7—continuously monitoring your business, automatically investigating changes, and proactively alerting you to risks and opportunities. From weeks of manual analysis to seconds of AI-generated insights. From reactive reporting to agentic intelligence. From data silos to unified, self-operating analytics.

Introducing Pharma Intelligence

Unified decision intelligence across your entire commercial operation

Pharma teams depend on fast, accurate insights across HCP targeting, field execution, market access, contracting, brand growth, patient services, and incentive compensation. Pharma Intelligence brings all these capabilities together—powered by AI analytics and agentic workflows—to help organizations unify data, explain performance, detect risks, and drive next-best actions across every commercial function.

📊 Analytics Solutions for Every Commercial Function

📊

Analytics Solutions for Every Commercial Function

Each hub addresses critical challenges with unified data, instant root cause analysis, and AI-powered insights. Choose your area to explore how we solve your specific pain points.

Field Force Sales Effectiveness

📝

34 Questions

⏱️

6,000 words

Pharma teams depend on fast, accurate insights across HCP targeting, field execution, market access, contracting, brand growth, patient services, and incentive compensation. Pharma Intelligence brings all these capabilities together—powered by AI analytics and agentic workflows—to help organizations unify data, explain performance, detect risks, and drive next-best actions across every commercial function.

Critical Capabilities:

HCP targeting & segmentation (AI-powered scoring)

Territory performance vs. potential (real-time)

Call quality & message effectiveness (NLP analysis)

Prescriber churn prediction (early warning alerts)

Pre-call planning (automated contextual briefs)

Brand Performance & KPIs

📝

31 Questions

⏱️

6,500 words

Transform business reviews and root cause analysis with instant TRx/NBRx explanations, automated market share decomposition, and complete narrative generation. Uncover hidden opportunities worth millions while reducing prep time from 2 weeks to 2 days—eliminating the endless Excel work and manual investigation cycle.

Critical Capabilities:

TRx/NBRx anomaly detection & auto-explanation

Market share decomposition (instant driver analysis)

Root cause analysis (multi-variable, seconds not days)

Business review automation (narrative + visuals)

Competitive intelligence (continuous tracking)

Market Access Performance

📝

30 Questions

⏱️

5,500 words

Track formulary changes, prior auth approval rates, and payer mix shifts with unified access intelligence—identifying exactly where coverage restrictions cost you scripts before they impact revenue. Get automated alerts on formulary movements, access barriers, and abandonment patterns with recommended interventions.

Critical Capabilities:

Formulary impact alerts (position change detection)

Prior authorization tracking (approval rate trends)

Payer mix dynamics (coverage shift analysis)

Abandonment prediction (access barrier identification)

Copay program ROI (effectiveness measurement)

Contracting & Payer Strategy

📝

30 Questions

⏱️

5,500 words

Optimize contract performance with unified tracking of rebate effectiveness, volume commitments, and ROI across all payer agreements. Model negotiation scenarios, measure contract impact in real-time, and identify which agreements deliver value and which underperform—with recommended actions before renewals.

Critical Capabilities:

Performance vs. expectations (continuous tracking)

Rebate effectiveness (automated optimization)

Scenario modeling (what-if negotiations)

Gross-to-net decomposition (contract-level)

Value-based outcomes (automated tracking)

HCP Targeting & Segmentation

📝

30 Questions

⏱️

5,500 words

Identify high-potential prescribers with AI-powered lookalike modeling, calculate physician lifetime value in real-time, and dynamically adjust segmentation as market conditions change. Find opportunities before competitors while optimizing targeting continuously—without manual deciling or static segment updates.

Critical Capabilities:

High-potential identification (AI-powered scoring)

Lookalike modeling (predictive targeting)

Prescriber LTV calculation (real-time updates)

Dynamic micro-segmentation (adaptive)

Acquisition optimization (prescriber journey)

⚡

Two Powerful Approaches to Analytics Transformation

⚡ Two Powerful Approaches to Analytics Transformation

Combine conversational interfaces for instant answers with agentic intelligence that works proactively—solving both immediate needs and long-term efficiency.

Conversational Analytics & AI Foundations

📝

25 Questions

⏱️

4,500 words

The foundation: Ask questions in plain English and get instant answers. Conversational interfaces democratize data access, automated root cause analysis explains why metrics moved, and predictive models forecast future performance. Essential AI capabilities that transform static dashboards into interactive intelligence.

Foundational AI Capabilities:

Conversational analytics (natural language queries)

Automated root cause analysis (driver decomposition)

Predictive modeling (prescription trend forecasting)

Machine learning (segmentation & targeting)

Unified data integration (IQVIA, CRM, claims, digital)

Agentic Analytics: AI Agents That Work 24/7

📝

25 Questions

⏱️

4,500 words

The evolution: AI agents work continuously 24/7—monitoring your business, automatically investigating anomalies, and proactively alerting you to risks and opportunities before you ask. Move from asking questions to receiving answers you didn't know you needed. This is what separates reactive analytics from agentic intelligence.

Agentic Capabilities:

24/7 monitoring (continuous surveillance)

Automatic anomaly investigation (self-initiated RCA)

Proactive risk alerts (before revenue impact)

Self-optimizing workflows (adaptive intelligence)

Automated business narratives (review generation)

Platform & Technology Questions

Understanding Pharma Intelligence and agentic analytics at the platform level

What is agentic analytics for pharmaceutical commercial operations

Agentic analytics represents the evolution from reactive reporting to proactive intelligence. Unlike traditional analytics where users must ask questions and wait for answers, agentic analytics deploys AI agents that work continuously—monitoring your business 24/7, automatically investigating anomalies, and proactively alerting you to risks and opportunities before you ask. In pharmaceutical commercial operations, this means AI agents track hundreds of metrics across brand performance, field execution, market access, and HCP engagement simultaneously. When meaningful changes occur—like a TRx decline, formulary restriction, or prescriber disengagement—agents automatically perform root cause analysis and deliver specific, actionable recommendations with full context.

How does Pharma Intelligence unify data across commercial functions?

Pharma Intelligence automatically integrates data from IQVIA (prescription trends, market share), Symphony (claims data), CRM systems (Veeva, Salesforce for field activity), payer databases (formulary status, prior auth rates), competitive intelligence, and internal systems. The platform creates a unified semantic layer that harmonizes these disparate sources, resolving HCP identities, aligning geographies, and standardizing metrics. This means field teams, brand managers, market access leaders, and contracting teams all work from the same single source of truth. When an AI agent detects a TRx decline, it can instantly correlate field activity, payer changes, competitive moves, and HCP prescribing patterns—insights impossible when data sits in silos.

What's the difference between AI analytics and agentic analytics?

AI analytics provides conversational interfaces and automated insights—you ask "Why did NBRx decline?" and get instant answers with root cause analysis. This is valuable and represents a major improvement over traditional BI. Agentic analytics goes further: AI agents work autonomously without human prompting. They continuously monitor your business, automatically detect meaningful changes, investigate root causes on their own, and proactively send you alerts with recommendations. Think of it as the difference between having a very smart assistant who answers your questions (AI analytics) versus having a team of analysts working 24/7 who investigate issues and bring you insights before you know to ask (agentic analytics). Most organizations need both layers working together.

What ROI can we expect from deploying agentic analytics?

Typical pharmaceutical companies see $10-17M in annual value creation per brand with 6-9 month payback periods and 1,700%+ first-year ROI. Value comes from four areas: analyst time savings (70-85% reduction, ~$645K annually), proactive issue detection (catching formulary changes, prescriber churn, access barriers 2-4 weeks earlier saves $3-4M), AI-identified opportunities (underserved segments, high-potential HCPs, contract optimization worth $5-10M), and improved forecasting accuracy ($2-3M in better resource allocation). Beyond quantifiable ROI, organizations report dramatically improved executive satisfaction, faster business reviews (2 weeks to 2 days), and field teams spending time selling instead of preparing reports. The platform essentially pays for itself within the first quarter through time savings alone.

How do AI agents work across field force, brand, and market access?

AI agents operate across all commercial functions simultaneously, detecting insights that span multiple teams. For example: an agent monitoring market access detects Aetna added step therapy requirements affecting 8,200 covered lives. It automatically investigates the brand impact (estimated -$2.3M TRx), identifies affected territories and HCPs, analyzes which field reps need to adjust messaging, and calculates the patient support program implications. Within minutes, the agent sends coordinated alerts to market access (escalate with payer), brand team (update forecasts), field leadership (prioritize affected HCPs), and patient services (expect abandonment increase). This cross-functional intelligence—impossible with siloed tools—enables coordinated responses that protect revenue.

How long does deployment take and what resources are needed?

Typical deployment takes 6-12 weeks from kickoff to full production. Week 1-3: Data integration (IQVIA, CRM, claims, payer sources). Week 4-6: Semantic layer configuration and pharma-specific metric definitions. Week 7-9: Agent deployment, alert configuration, and user training. Week 10-12: Optimization and rollout. Required resources: Executive sponsor (5% time), 2-3 business analysts (50% time during deployment), IT liaison (25% time for data access), and key business users for UAT. Post-deployment, platform is largely self-operating—AI agents handle monitoring and investigation automatically. Most organizations need only 1-2 FTEs for ongoing administration, far less than traditional BI platforms that require constant analyst support.

How does this compare to traditional pharma analytics platforms?

Traditional platforms (Tableau, Power BI, Qlik) require users to build dashboards, write SQL, and manually investigate every question. Pharma-specific platforms (IQVIA OCE, Veeva CRM Analytics) provide pre-built reports but still require manual analysis. Neither offers AI agents that work autonomously. With agentic analytics, AI agents continuously monitor and investigate automatically—no dashboard building, no SQL, no waiting. Conversational interfaces let anyone ask questions in plain English. Root cause analysis happens instantly, not in 3-5 days. Business reviews generate automatically. Most importantly: you receive insights proactively before issues impact revenue, rather than discovering problems in retrospective reports. Organizations typically keep existing platforms for specific use cases while Pharma Intelligence becomes the primary decision intelligence layer.

How Agentic Analytics Transforms Your Workflow

How Agentic Analytics Transforms Your Workflow

Unified Data Integration

Automatically connect and harmonize data from IQVIA, Symphony, CRM (Veeva, Salesforce), claims databases, competitive intelligence, and internal systems. No more manual data pulls or Excel wrestling.

Ask Questions in Plain English

Conversational analytics lets anyone ask questions like "Why did NBRx decline in the Northeast last month?" and receive instant answers with automated driver analysis. No SQL, no waiting for reports.

Deploy AI Agents

Agentic analytics agents work 24/7—continuously monitoring hundreds of metrics across all dimensions. When meaningful changes occur, agents automatically investigate root causes, quantify business impact, and send prioritized alerts with specific, actionable recommendations. No human prompting required.

Receive Proactive Insights & Recommendations

Get specific, prioritized alerts with context and next steps: "Prior auth denials increased 18% with Aetna in Q3. Estimated TRx impact: -$2.3M. Root cause: New step therapy requirement. Recommend: Escalate to market access team within 48 hours, review formulary status across all major payers." Know what to do, not just what happened.

Jump to Your Specific Challenge

AI agents answer your questions across three levels: foundational understanding, agentic capabilities, and business impact measurement.

🎯

Understanding Challenges & Best Practices

🎯 Understanding Challenges & Best Practices

🤖

AI Agents & Agentic Capabilities

🤖 AI Agents & Agentic Capabilities

💰

Platform Evaluation & Business Impact

💰 Platform Evaluation & Business Impact

Real Results from Deploying Agentic Analytics

How AI agents deliver measurable business impact across pharmaceutical commercial operations

Top 10 Pharma — Oncology Brand

85% reduction in monthly review prep with automated business narratives

AI agents identified $12M opportunity in underserved community oncology

Proactive formulary alerts detected risk 3 weeks earlier, saved $8M

ROI: 2,200% in first year with agentic monitoring

Specialty Pharma — Neurology

Analyst team reduced from 4 FTEs to 2 with agentic automation

15% NBRx improvement through AI-optimized HCP targeting

Agentic anomaly detection prevents $3-5M revenue loss annually

Payback period: 7 months from agent deployment

Mid-Size Pharma — Cardiovascular

AI agents generate weekly reviews in 2 hours vs. 2 days

Root cause analysis: instant vs. 3-5 days of manual investigation

Agents found $18M in hidden payer contract optimization opportunities

Executive satisfaction: 4.2 → 9.1/10 with agentic insights

Calculate Your ROI from Agentic Analytics

See what you could save by deploying AI agents across your commercial operations

Typical ROI from Agentic Analytics Deployment

Value from AI agents: Analyst time savings ($645K), proactive issue detection ($3-4M), AI-identified opportunities ($5-10M), improved forecasting ($2-3M), 24/7 monitoring & investigation (at fraction of human cost)

Breakthrough Ideas, Right at Your Fingertips

Dig into our latest guides, webinars, whitepapers, and best practices that help you leverage data for tangible, scalable results.

.png)

Best Augmented Analytics Platforms in 2026: 12 Tools Compared for Automated Insight Discovery, Governance, and Analytical Depth

This blog reviews 12 augmented analytics platforms in 2026 and explains what separates AI-assisted BI from true automated analytics: insight discovery, root cause decomposition, natural language explanation, predictive AI, proactive monitoring, and governed consistency—plus the new frontier of agentic workflows that investigate and deliver insights end-to-end. It provides clear “best for” recommendations and an evaluation framework focused on analytical depth, governance, and total cost of ownership.

Best Revenue Intelligence Platforms in 2026: Clari, Gong, Tellius & 7 More Compared

This post compares 10 revenue intelligence platforms for 2026 and explains the “Revenue Root Cause Gap”—why most tools show what happened in pipeline and forecasts, but can’t investigate why across CRM, conversations, and documents. It evaluates each platform on pipeline analytics, root-cause depth, data sources, proactive monitoring, conversational analytics, and total cost of ownership, with clear “best for” recommendations.

Best AI Platforms for Pharma Field Force Effectiveness in 2026: 10 Platforms Compared

A 2026 comparison of 10 AI platforms for pharma Field Force Effectiveness, focused on what actually separates “agentic” FFE analytics from dashboards: automated deep insights (root cause), proactive monitoring, governed Q&A, pharma data integrations, and workflow orchestration—plus clear “best for” recommendations by use case and team maturity.

.png)

Tellius AI Agents: Driving Real Analysis, Action, + Enterprise Intelligence

Tellius AI Agents transform business intelligence with dedicated AI squads that automate complex analysis workflows without coding. Join our April 17th webinar to discover how these agents can 100x enterprise productivity by turning questions into actionable insights, adapting to your unique business processes, and driving decisions with trustworthy, explainable intelligence.

PMSA Fall Symposium 2025 in Boston

Join Tellius at PMSA Oct 2–3 for two can’t-miss sessions: Regeneron on how they’re scaling GenAI across the pharma brand lifecycle, and a hands-on workshop on AI Agents for sales, HCP targeting, and access wins. Discover how AI-powered analytics drives commercial success.

.png)