How Agentic Analytics Is Transforming Pharma Brand & Commercial Insights (With Real Use Cases)

Intro

Agentic analytics is a new approach to commercial insights where AI agents autonomously pull data from multiple sources, validate what they find, and surface answers—without waiting on analyst queues or manual data wrangling. For pharma brand teams, this means competitive share questions answered in minutes instead of days, performance drivers identified automatically, and launch signals caught while there's still time to act.

Why is this important? Because pharma brand insights teams aren't short on data—IQVIA, Symphony, Veeva, claims feeds, market research, internal sales tracking. The problem is the operating model. Most commercial analytics tech stacks were built to produce monthly reports, not to answer fire-drill questions and deep dives.

Effective commercial insights teams are rethinking what their analysts and team members spend time on. Instead of wrangling exports and reconciling data sources, they're offloading the investigative grunt work to agentic AI—systems that investigate rather than just respond, delivering defensible answers while the question still matters.

This guide covers what's breaking in brand analytics and a practical path forward.

Where brand analytics breaks down

Most pharma commercial insights teams are dealing with some version of the same three problems, with specifics varying by company and therapeutic area:

The 5-system shuffle: Answering a straightforward brand question often requires pulling from IQVIA prescription data, Symphony claims, Veeva CRM activity, internal sales numbers, and whatever market research came back last quarter. Each system has different formats, update cycles, and patient or HCP identifiers. Joining them requires SQL skills most brand analytics teams don't have in-house, and by the time someone's stitched everything together, the business question has changed. The result is low confidence in "the number," constant reconciliation debates, and insights that show up too late to matter.

Death by a thousand Excel exports: A brand performance review shouldn't take three days to prepare for a 30-minute discussion, but it often does. The workflow is painfully manual: pulling data from one system, cleaning it in another, reformatting it for slides, then repeating the whole process when numbers refresh or a stakeholder asks for a different cut (and they will). Meanwhile, the work that actually influences brand strategy keeps getting pushed to next week.

The speed-versus-rigor tradeoff: Your team knows that delivering credible competitive share impact analysis requires matched patient cohorts, validated attribution windows, and enough weeks of prescription data to distinguish signal from noise. But when the brand team needs answers by end of day, those timelines don't work. So you get one of two outcomes: a rushed answer that might not hold up under scrutiny, or a bulletproof analysis that arrives after the decision's been made. Do this enough times and the insights team stops getting asked.

The three most common bottlenecks in pharma brand analytics, and their downstream impact on insights teams

These aren't new problems. Most insights leaders have been managing some version of them for years. What's changed is that the volume and velocity of decisions has outpaced the operating model.

Traditional brand analytics was built for reporting cycles: monthly business reviews, quarterly deep dives, annual planning. The tools reflect that. Dashboards show what happened last month. They're not designed to answer "why did NBRx drop in the Northeast last week" while there's still time to do something about it. The current model requires humans to do everything: frame the question, pull the data from five systems, validate the answer, build the deck, and defend the methodology. That workflow made sense when brand teams needed answers once a month. It falls apart when they need answers twice a week.

Hiring more analysts won't fix this. You can't staff your way out of a structural mismatch between how insights get produced and how decisions get made.

What separates high-performing commercial insights teams from low-performing ones

Before getting into solutions, it's worth looking at what the top commercial insights teams do differently.

%20-%20Edited.png)

A few things stand out. These teams are embedded in brand decisions as they happen, not brought in afterward to validate what's already been decided. Their data sources are unified enough that nobody wastes cycles debating whose numbers are right. When leadership asks a question, the answer includes "why" and "what to do about it," not just a chart showing red or green. And success gets measured by whether insights actually changed a decision, not by how many reports went out the door.

If that doesn't describe your team, you're not alone. Most pharma insights organizations are stuck in reactive mode, not because of a talent gap, but because the operating model forces it.

The technology that actually matters

You've probably sat through plenty of vendor pitches promising AI will solve everything. Most of it has been underwhelming: chatbots that can't handle pharma terminology, "insights" that are really just visualizations, tools that require a data science team to operate.

So, what key technologies are lacking to unlock a smarter way to gather commercial insights?

Semantic Layer: Most AI tools fail in pharma because they don't understand the domain. They don't know that TRx and NBRx mean different things, that a "patient" in claims data isn't the same as a "patient" in CRM data, or that access dynamics vary wildly by payer and region. A semantic layer solves this by encoding pharma commercial logic into the system: metric definitions, entity relationships, business rules around things like launch curves and formulary impact. It's what makes the difference between an AI that gives you a technically correct but useless answer and one that actually understands the question.

AI Agents: Gartner identifies AI agents as one of the two fastest-advancing technologies in 2025. Unlike standard GenAI tools that take a question and return an answer, agentic systems investigate rather than respond. They break a question into sub-analyses, pull from multiple data sources, check whether the results make sense, and explain their confidence level. When you ask "why did NBRx drop in the Northeast last month," a standard tool might show you a chart. An agentic system investigates: Was it a competitive launch? A formulary change? A seasonal pattern? It tests each hypothesis against the data and tells you which explanation holds up, along with what it couldn't rule out.

Agentic analytics in practice

Here's how agentic commercial analytics maps to the problems outlined earlier.

The 5-system shuffle → unified data layer

Instead of manually joining IQVIA, Symphony, Veeva, and internal data for every request, agentic platforms connect to pharma data sources out of the box. A data federation layer handles the messy work of reconciling different formats, update cycles, and identifiers. Your team queries across systems in plain language without writing SQL or waiting on IT.

Death by a thousand Excel exports → analysts ask, agents do

The grunt work—pulling data, cleaning it, formatting it for different stakeholders—gets offloaded to AI agents. Brand teams can get answers directly without routing every question through the insights team. Your analysts stop being report factories and start doing the strategic work they were hired for.

The speed-versus-rigor tradeoff → fast answers you can trust

Agentic systems don't just return results quickly. They validate as they go: checking for anomalies, flagging data gaps, and explaining confidence levels. When something looks off, the system tells you why before you put it in front of leadership.

How agentic analytics addresses core pharma brand analytics bottlenecks.

Agentic Commercial Insights Use Cases

Let’s explore four scenarios where agentic analytics makes a tangible difference for brand insights teams.

Market share insights

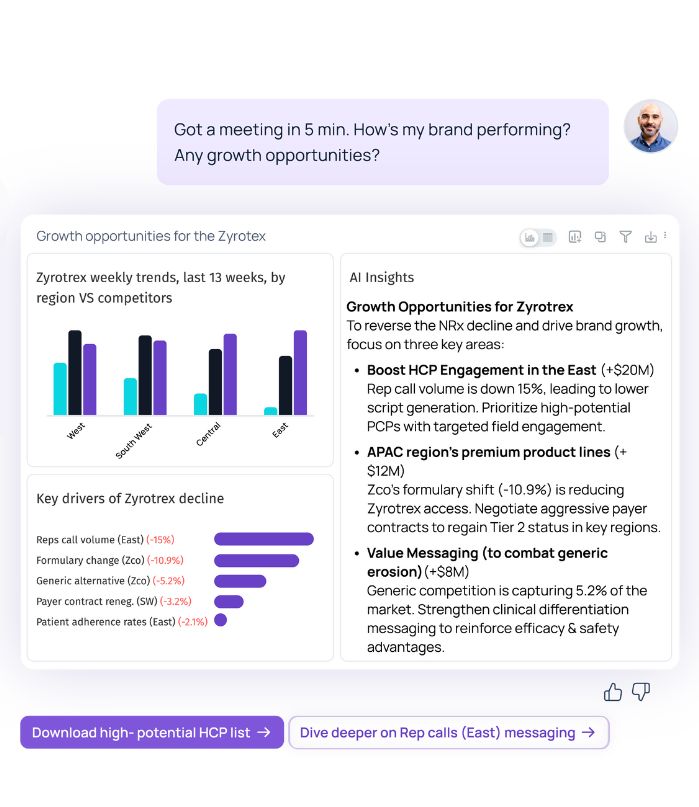

The situation: You've got a meeting in five minutes and someone asks how your brand is performing against the top competitor in a specific region. Normally this goes into the analyst queue and comes back in a day or two.

With agentic analytics: You ask the question in plain language, the system pulls from claims and prescription data, and you have a defensible answer before the meeting starts. Not a rough guess—an actual answer with the methodology visible.

ROI Example: A midsize pharmaceutical firm's brand insights team noticed a 12% drop in market share for a particular drug.Using automated market share insights with Tellius, the team identified the systemic drivers of underperformance and growth opportunities, informing pull-through strategy. The resulting course correction drove an increase in the brand's market share by 7%, contributing $7.19 million in sales; reached underserved HCPs to achieve a 43% increase in demand; and improved the team's response time to market changes.

Performance driver analysis

The situation: Your centralized brand insights team is spending six figures per quarter on how outside consultants to run analyses on prescriber behavior, competitive performance, and market share dynamics.

With agentic analytics: The same diagnostic work happens in-house, on demand. When leadership asks "what drove NBRx growth for Brand A versus Brand B in Q3," your team can answer in hours instead of commissioning a study.

ROI Example: A global life science firm’s centralized brand insights team was spending a lot of money on outside consultants to perform various brand analysis related to prescriber behavior, competitive performance, and market share dynamics. Using Tellius, the brand team is able to easily perform complex analysis leading to insights that have improved sales and marketing efficiency, while reducing the reliance on consultants, saving money, and speeding up time to analysis.

Omnichannel engagement analytics

The situation: Marketing ops has run hundreds of KOL sessions and can't tell which ones actually influenced prescribing behavior. The data lives in three different systems and nobody has time to stitch it together.

With agentic analytics: Segment tracking updates automatically. You can see adoption patterns by specialty, identify switching behaviour, and ajust targeting without waiting for the next quarterly review.

ROI Example: A top 20 pharmaceutical firm’s Marketing Ops team was struggling to understand the impact of 6000 KOL sessions on HCP influence as part of their omni channel marketing campaigns. They had siloed dashboards. The result was a holistic view into campaign effectiveness for quicker decision making and course correcting for better-optimized marketing resources. The result was a holistic view into campaign effectiveness for quicker decision making and course correcting for better-optimized marketing resources.

Automated segmentation analysis

The situation: Your customer segments were built two years ago and haven't been updated since. Launch learning is slow because nobody has bandwidth to track which specialties are adopting and why.

With agentic analytics: Segment tracking updates automatically. You can see adoption patterns by specialty, identify switching behavior, and adjust targeting without waiting for the next quarterly review.

ROI Example: A major pharmaceutical firm's monthly brand reviews featured segmentation performance data that was two months stale by the time it reached leadership. Refresh cycles were quarterly, and any ad-hoc questions about segment behavior went into an analyst queue. Using agentic analytics, the brand insights team enabled on-demand segment performance monitoring tied to prescription data. Within three months, they identified that adoption among a key specialty segment was lagging projections by 18%—an issue that wouldn't have surfaced until the next quarterly refresh. The early signal allowed commercial ops to adjust messaging and targeting priority, recovering 11% of projected segment share by end of launch year. Analyst time spent on recurring segment performance reporting dropped by approximately 60%.

.png)

Where Tellius Kaiya fits in

Tellius Kaiya was built for this problem. It's an agentic analytics platform designed specifically for pharma commercial analytics, with three things that matter for brand insights teams:

- Semantic understanding of pharma data. Kaiya knows what TRx, NBRx, and NPS mean. It understands the difference between a prescriber and a patient, how formulary status affects access, and why launch curves look different by therapeutic area. You don't have to teach it your business.

- Agentic reasoning, not just chat. When you ask a question, Kaiya doesn't just query a database and return a chart. It breaks the question down, pulls from multiple sources, validates the results, and explains what it found and how confident it is. It investigates like an analyst would, just faster.

- Conversational interface built for brand teams. The people asking questions don't need SQL skills or analyst support. They ask in plain language, get answers they can act on, and see the methodology behind it.

The goal isn't to replace your insights team. It's to get them out of the data-wrangling business so they can focus on the work that actually influences brand strategy.

Implementation

Getting agentic analytics running isn't a multi-year transformation project. But it's not plug-and-play either (if an AI analytics vendor says otherwise, be cautious). A few things matter more than others.

.png)

Governance is not optional. Agentic systems can pull data from multiple sources and generate answers fast. That's powerful, but it also means you need clear guardrails. Who owns the metric definitions? How do you audit what the system produced? The principle to operate by: agents propose, humans decide. The AI surfaces answers and recommendations; your team validates and acts.

Start with one high-value workflow. Don't try to boil the ocean. Pick a use case where the current process is painful and the data is reasonably clean—competitive share tracking, launch monitoring, or territory performance are common starting points. Prove value there before expanding.

Make the system visibly right. Adoption lives or dies on trust. Early users need to see that the system gets the details right: correct metric definitions, accurate territory mappings, results that match what they'd get if they did the work manually. Build that credibility before rolling out broadly.

Plan for the role shift. Your analysts have been doing data wrangling and report production for years. That work is going away. Be explicit about what their job becomes: validating AI outputs, interpreting results for stakeholders, and doing the deeper strategic analysis that never had time before. If you don't address this head-on, you'll get resistance instead of adoption.

Conclusion

Pharma brand analytics has been stuck in the same operating model for years: fragmented data, manual workflows, and a chronic mismatch between how fast decisions need to happen and how long insights take to produce. The tools got prettier, but the bottlenecks stayed the same.

Agentic analytics breaks this cycle by shifting the work itself. Data integration happens automatically. Validation is built in. Analysts stop being report factories and start being strategic partners.

This isn't a future-state vision. The technology exists now, and leading pharma commercial teams at places like Novo Nordisk are already adopting it. The question is whether your team keeps fighting the same fires with the same tools, or starts operating differently.

Learn more about Tellius Kaiya for Brand Analytics,

Get release updates delivered straight to your inbox.

No spam—we hate it as much as you do!

BI tools show you what happened last quarter. Vanilla LLMs can answer simple questions but choke on enterprise pharma complexity—they don't know the difference between TRx and NBRx or how to handle mismatched patient identifiers across data sources. Agentic commercial analytics and insights platforms understands pharma commercial logic, pulls from multiple systems in a single query, and validates its own outputs before surfacing an answer. When you ask why NBRx dropped in a region, it investigates competing hypotheses rather than just returning a chart.

Most teams get a first use case live in 3-6 weeks. That includes connecting to your existing data sources (IQVIA, Symphony, Veeva, internal sales), configuring the semantic layer with your specific metric definitions and business rules, and onboarding initial users from the brand or insights team. The longer timeline items are usually data access approvals and aligning on metric governance, not the technology itself.

Start with what you have. Most implementations begin with prescription data (IQVIA or Symphony), CRM activity from Veeva, and internal sales data. You don't need a perfect data warehouse or a completed master data management project. Tellius handles different update cycles, formats, and identifier mismatches—that's the problem it's designed to solve.

Measure what matters to your team. Time-to-insight is the clearest metric: if a competitive share analysis that used to take two days now takes 15 minutes, that's defensible. Track how much analyst time shifts from data wrangling to actual strategic work. Some teams also track consultant spend reduction—if you're spending $150K per quarter on outside firms for brand performance analysis, that's a direct comparison. The harder but more meaningful metric is decision influence: did insights actually change a brand decision that was in flight? Has it impacted decision velocity? If the platform is making even a 1% improvement this can translate to millions of dollars at most pharmaceutical firms.

Go for a use case that's high-frequency, visible, and politically safe to experiment with. Competitive share monitoring and monthly brand performance reviews are common starting points—they happen regularly, involve painful manual work, and have clear success criteria. Avoid starting with a high-stakes launch or an executive pet project. Prove the system works on routine work first, then expand to higher-risk scenarios.