Agentic Analytics for Pharma Market Access and Pricing Strategy

Reading time:

min

Published:

**In short:** Agentic analytics for pharma market access deploys AI agents that work 24/7 to do what traditional BI can't—continuously monitor pricing, payer, and competitive data across siloed sources, automatically diagnose access barriers, and surface actionable insights in natural language. Decisions that took weeks now happen overnight. Market access teams shift from reactive firefighting to proactive strategy, with AI agents handling GTN analysis, competitive intelligence, formulary tracking, and payer segmentation autonomously while humans focus on negotiations and strategic judgment.

# Agentic Analytics for Pharma Market Access and Pricing Strategy

Market access teams operate in a world where a single formulary decision can swing millions in revenue—yet most are still piecing together insights from spreadsheets, quarterly reports, and analyst requests that take weeks to fulfill. By the time the analysis arrives, the payer has already moved on.

Agentic analytics changes this equation. AI agents continuously monitor pricing, payer, and competitive data, surfacing insights and taking action autonomously—compressing decision cycles from weeks to minutes. This guide covers how agentic analytics transforms market access and pricing workflows, specific use cases for AI agents, implementation challenges, and a practical roadmap for getting started.

## Why traditional market access analytics fail pharma teams

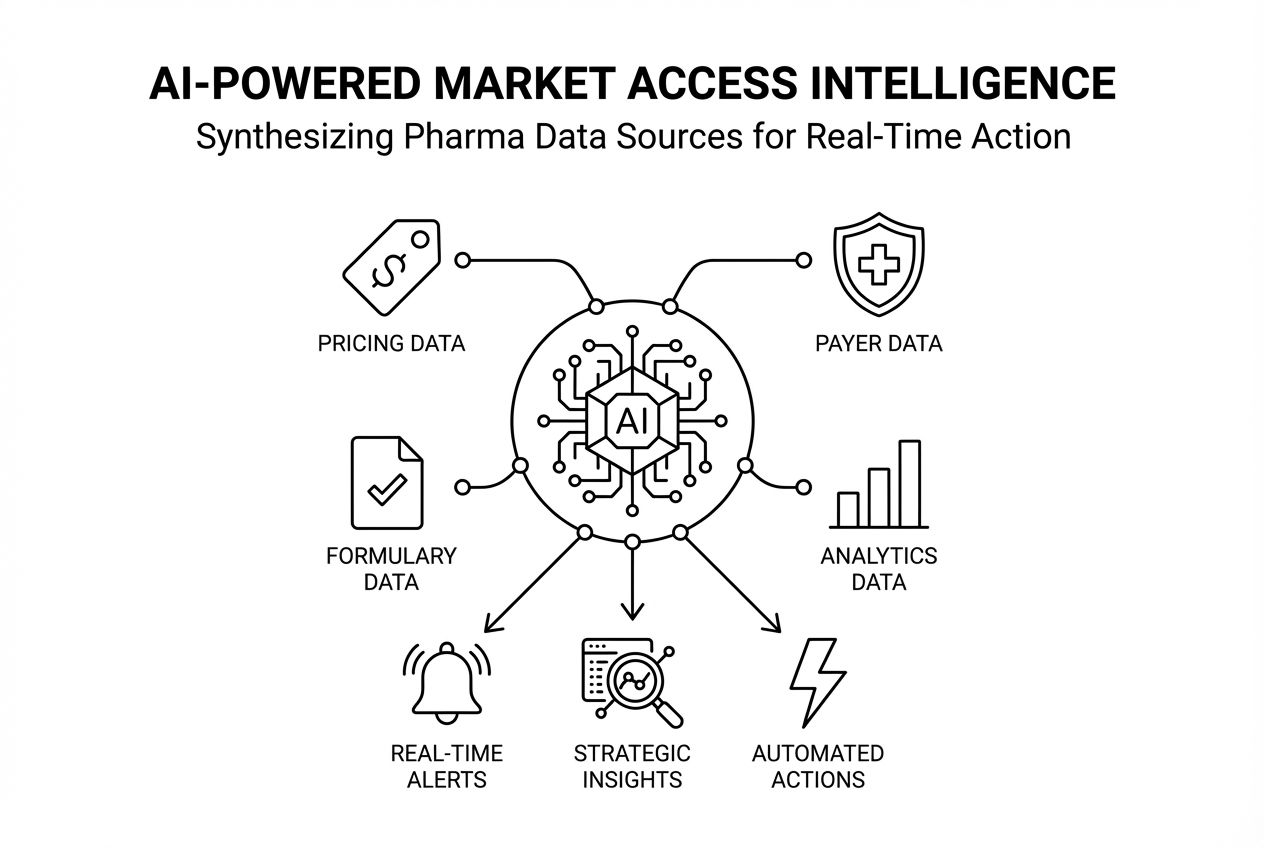

Agentic analytics for pharma market access refers to autonomous, goal-oriented AI systems that accelerate data-driven decision-making in securing favorable pricing, reimbursement, and patient access for new therapies. Unlike traditional analytics requiring manual data processing and human-led interpretation, agentic AI systems autonomously perform tasks, analyze diverse data sources, and provide actionable, real-time insights to optimize market access strategies.

So what's broken with the traditional approach? Let's walk through it.

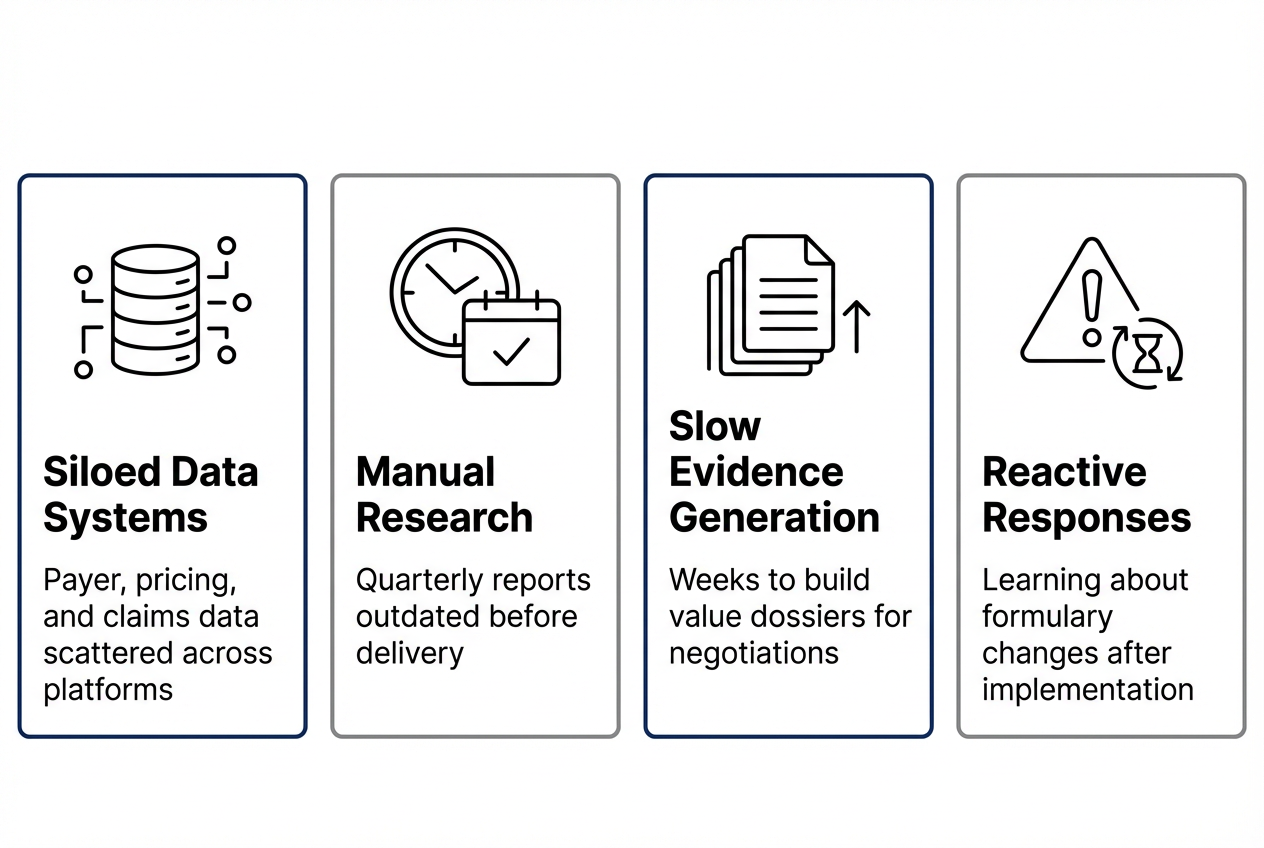

### Siloed data across payer, pricing, and competitive sources

Payer contract data lives in one system. Pricing databases sit in another. Claims data, competitive intelligence, and formulary information are scattered across yet more platforms. Market access teams spend enormous time manually stitching together data just to answer basic questions about access performance.

When you can't see the full picture, you're making pricing decisions with incomplete information.

### Manual competitive intelligence and pricing research

Tracking competitor WAC prices, rebate structures, and payer coverage decisions is labor-intensive work. Most teams rely on periodic reports—quarterly competitive updates, monthly pricing summaries—that are often outdated by the time they arrive.

Meanwhile, competitors may have already adjusted their positioning.

### Slow evidence generation for payer negotiations

Building value dossiers, HEOR summaries, and pricing justifications for payer meetings takes weeks. Analysts pull data from multiple sources, run analyses, create presentations, and route everything through review cycles. By the time the analysis is ready, the negotiation window may have closed.

### Reactive responses to formulary and reimbursement changes

Here's a common scenario: a major PBM adds step therapy requirements to your product, and your team learns about it after implementation. There's no time to mitigate the revenue impact or proactively engage physicians. Traditional analytics workflows simply can't keep pace with the speed of payer decisions.

_\[CAPTION: Four critical failures of traditional pharma market access analytics workflows\]_

---

## What is agentic analytics for market access

Agentic analytics combines AI agents—software entities that perceive, reason, plan, and act autonomously—with enterprise data to solve complex business problems without constant human prompting. In the market access context, AI agents continuously monitor pricing, payer, and competitive data, surfacing insights and taking action toward defined goals.

The distinction from traditional BI is significant:

| Traditional Market Access Analytics | Agentic Analytics for Market Access |

| --- | --- |

| Pull-based: analysts query data on request | Push-based: AI agents surface insights proactively |

| Static dashboards and periodic reports | Continuous monitoring with real-time alerts |

| Manual root cause investigation | Automated diagnosis of access barriers |

| Single data source analysis | Cross-source synthesis (payer, pricing, claims, competitive) |

| Reactive to market changes | Predictive identification of risks and opportunities |

A few key terms worth defining:

* **Agentic AI:** AI systems that autonomously plan, execute multi-step tasks, and take action toward defined goals without constant human prompting

* **Market access:** The discipline of ensuring patients can obtain and afford pharmaceutical products through favorable formulary placement, reimbursement, and pricing

* **Gross-to-net (GTN):** The difference between list price and net realized price after rebates, chargebacks, discounts, and fees

---

## How AI agents transform market access and pricing workflows

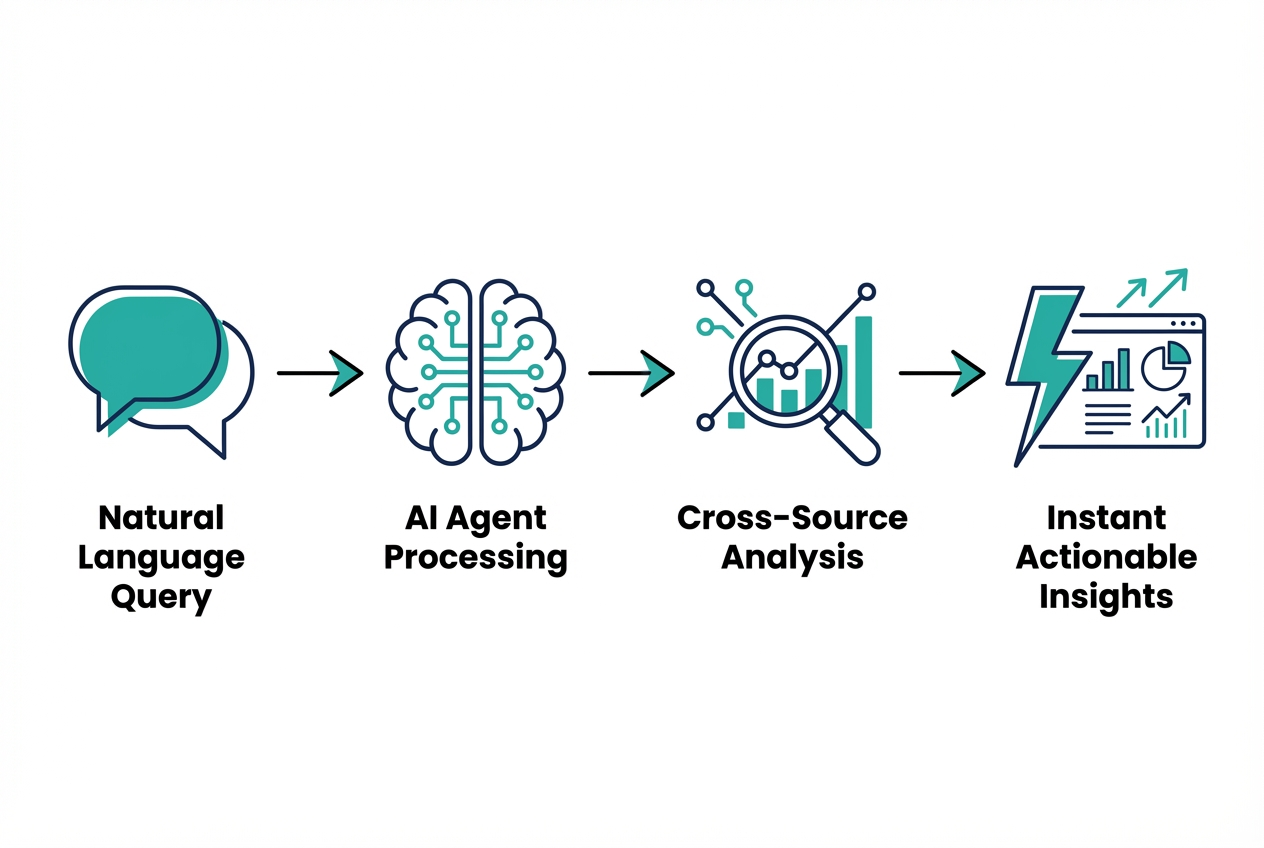

_\[CAPTION: AI agent workflow transforming natural language questions into real-time market access insights\]_

Now that we've established what agentic analytics is, let's look at how it actually works in practice.

### Natural language queries for pricing and access data

Imagine a market access manager asking: "What's our formulary coverage for Product X across commercial payers in the Northeast?" No SQL. No analyst request. No waiting.

AI agents translate natural language into queries across connected data sources, returning answers in seconds. Brand teams, field medical, and finance can all get answers without bottlenecks.

### Automated root cause analysis for access barriers

When access metrics decline, the traditional approach involves analysts manually investigating potential causes. Was it a formulary change? New step therapy? Competitive pressure?

AI agents trace the data lineage automatically. They examine formulary status changes, prior authorization additions, competitive pricing moves, and prescription trends—then present findings with supporting evidence. What took days now takes minutes.

### Continuous monitoring of competitive pricing and payer decisions

Rather than waiting for quarterly competitive intelligence reports, AI agents provide always-on surveillance. They track WAC changes, biosimilar launches, and coverage decisions across major payers simultaneously.

You're no longer reacting to competitive moves; you're anticipating them.

### Proactive alerts for formulary and reimbursement changes

AI agents detect early signals of formulary risk—prior authorization additions, tier demotions, exclusion rumors—and alert teams before changes take effect. This enables proactive outreach to payers or physicians rather than damage control after the fact.

---

## Market access and pricing use cases for AI agents

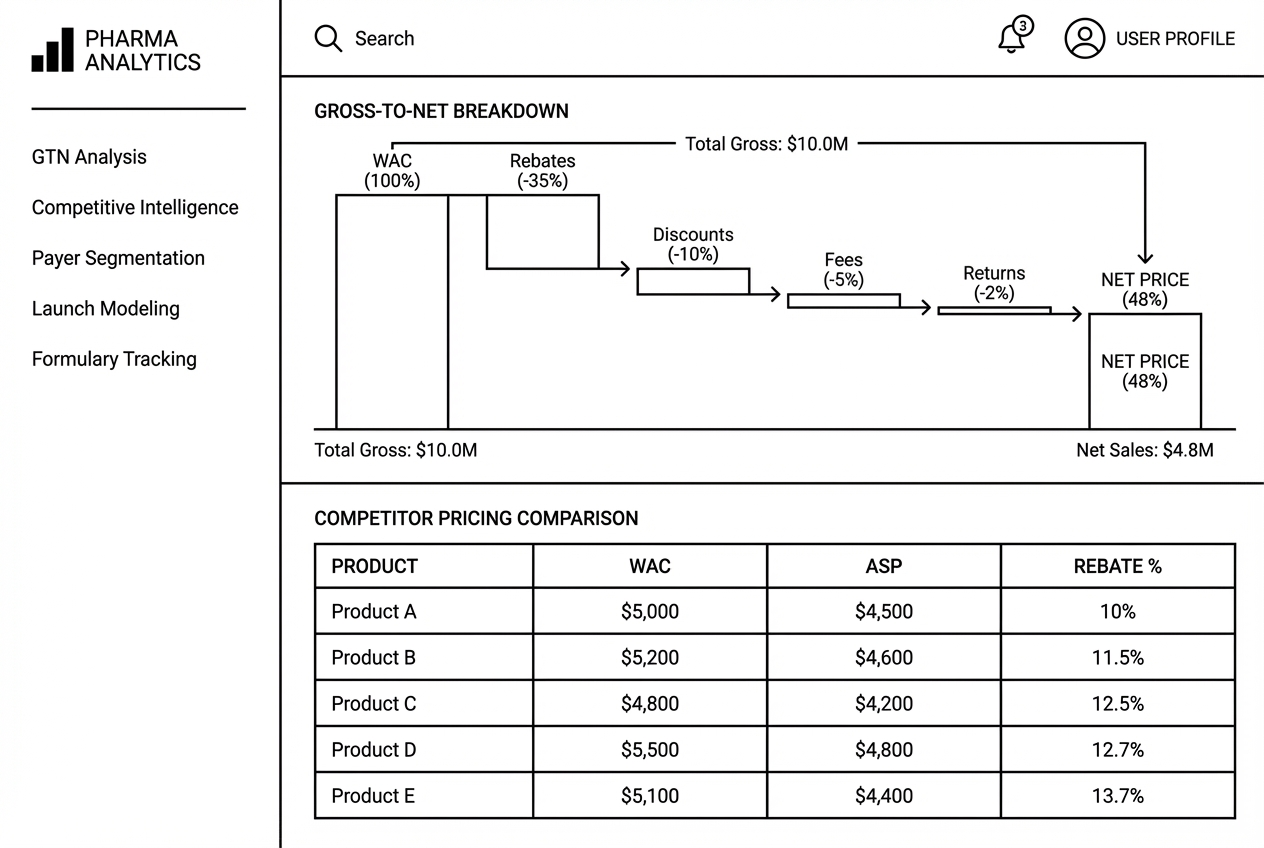

_\[CAPTION: Agentic analytics dashboard showing gross-to-net analysis and competitive pricing intelligence\]_

Let's get specific about where agentic analytics delivers the most value.

### Gross-to-net analysis and optimization

GTN erosion is one of the biggest challenges in pharma pricing. AI agents help by:

* **Decomposing the GTN waterfall:** Breaking down each component—Medicaid rebates, 340B chargebacks, commercial rebates, distribution fees—contributing to net price erosion

* **Identifying anomalies:** Flagging unexpected spikes in chargebacks or rebate accruals before they hit the P&L

* **Modeling optimization scenarios:** Simulating the impact of contract changes, price adjustments, or channel mix shifts on net revenue

### Competitive pricing intelligence

AI agents continuously track competitor pricing across multiple dimensions:

* **WAC/ASP changes:** Monitoring list price and average sales price movements in real time

* **Contract positioning:** Analyzing how competitors are positioning in payer contracts based on formulary outcomes

* **Biosimilar/generic entry:** Alerting teams to new entrants and their pricing strategies before they impact market share

### Payer segmentation and targeting

Not all payers are created equal. AI agents segment payers by access opportunity (which payers have the most patient volume but weakest coverage), contract renewal timing (prioritizing outreach based on upcoming renewals), and influence potential (identifying regional payers who set trends others follow).

### Launch pricing scenario modeling

For new product launches, AI agents support pricing decisions by modeling different scenarios across payer archetypes, competitive reference points, and GTN assumptions. Teams can stress-test pricing strategies before market entry.

### Formulary status and access tracking

AI agents continuously track formulary positions, tier placements, and utilization management requirements (PA, step therapy, quantity limits) across commercial, Medicare Part D, and Medicaid. They roll up access metrics by geography, payer type, or product.

---

## Key challenges in adopting agentic AI for pharma market access

Agentic analytics isn't without obstacles. Being realistic about challenges helps set appropriate expectations.

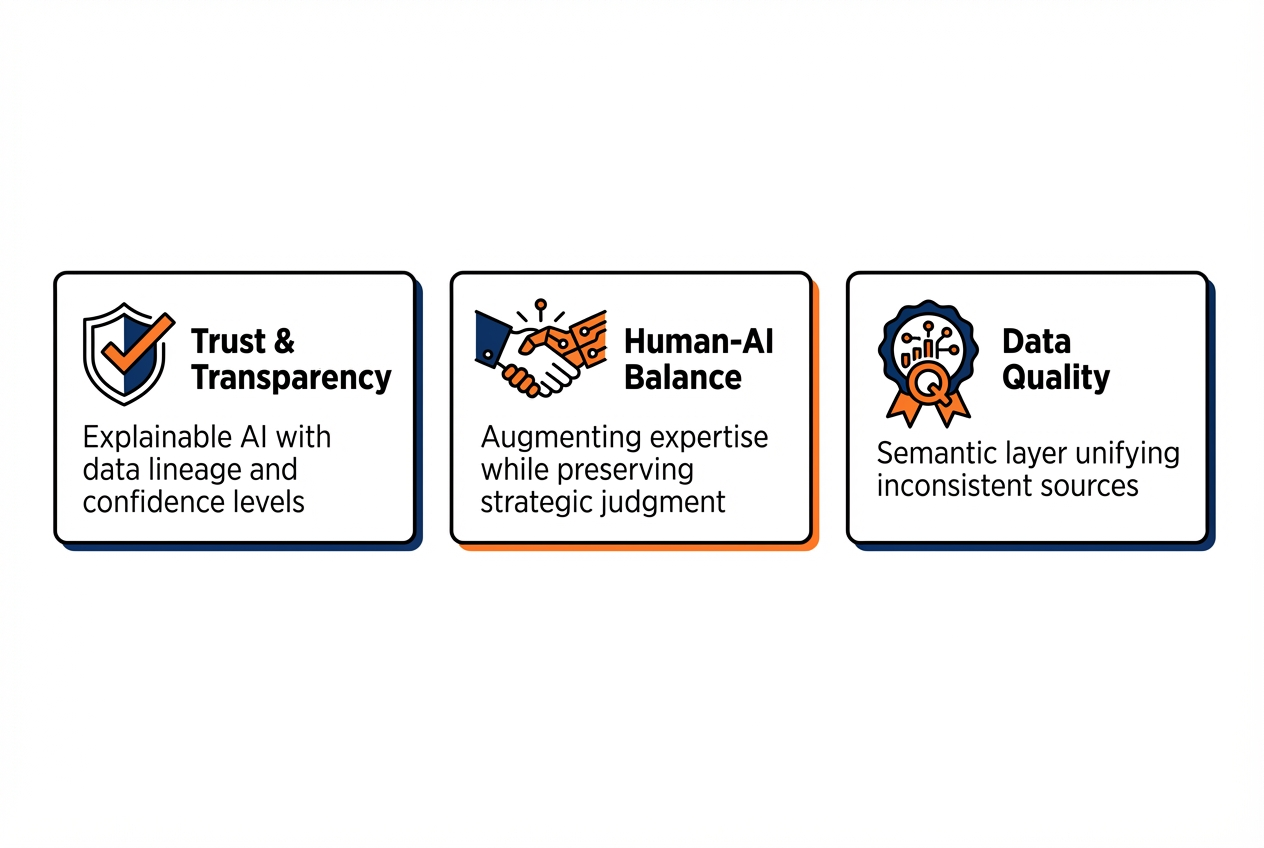

### Building trust in AI-driven pricing recommendations

Pricing decisions carry significant financial and reputational risk. A recommendation to adjust WAC or modify rebate structures can't come from a black box.

Market access teams require explainable AI that shows its reasoning—citing sources, displaying data lineage, and presenting confidence levels. Without transparency, adoption stalls.

### Balancing automation with human expertise

Market access strategy requires human judgment. Payer relationships, competitive dynamics, regulatory considerations, and corporate strategy can't be fully automated.

The right model positions AI agents as augmenting human expertise, not replacing it. Humans set strategy; agents accelerate execution and surface insights humans might miss.

### Ensuring data quality across market access sources

Garbage in, garbage out applies especially to market access data. Common challenges include data latency (claims and rebate data often lag by weeks or months), source inconsistency (different vendors use different payer naming conventions), and completeness gaps (not all payer contracts or formulary changes are captured in available data).

A semantic layer—a unified data model that standardizes definitions across sources—helps address data quality issues by ensuring AI agents work with consistent, trustworthy data. Platforms like Tellius provide a semantic layer that unifies market access data sources, enabling AI agents to query across pricing, payer, and competitive data without requiring manual data preparation for each question.

_\[CAPTION: Three key challenges and their solutions to implementing agentic AI for pharma market access; trust, human-in-the-loop, and a semantic layer built on quality data\]_

---

## How to get started with agentic analytics for market access

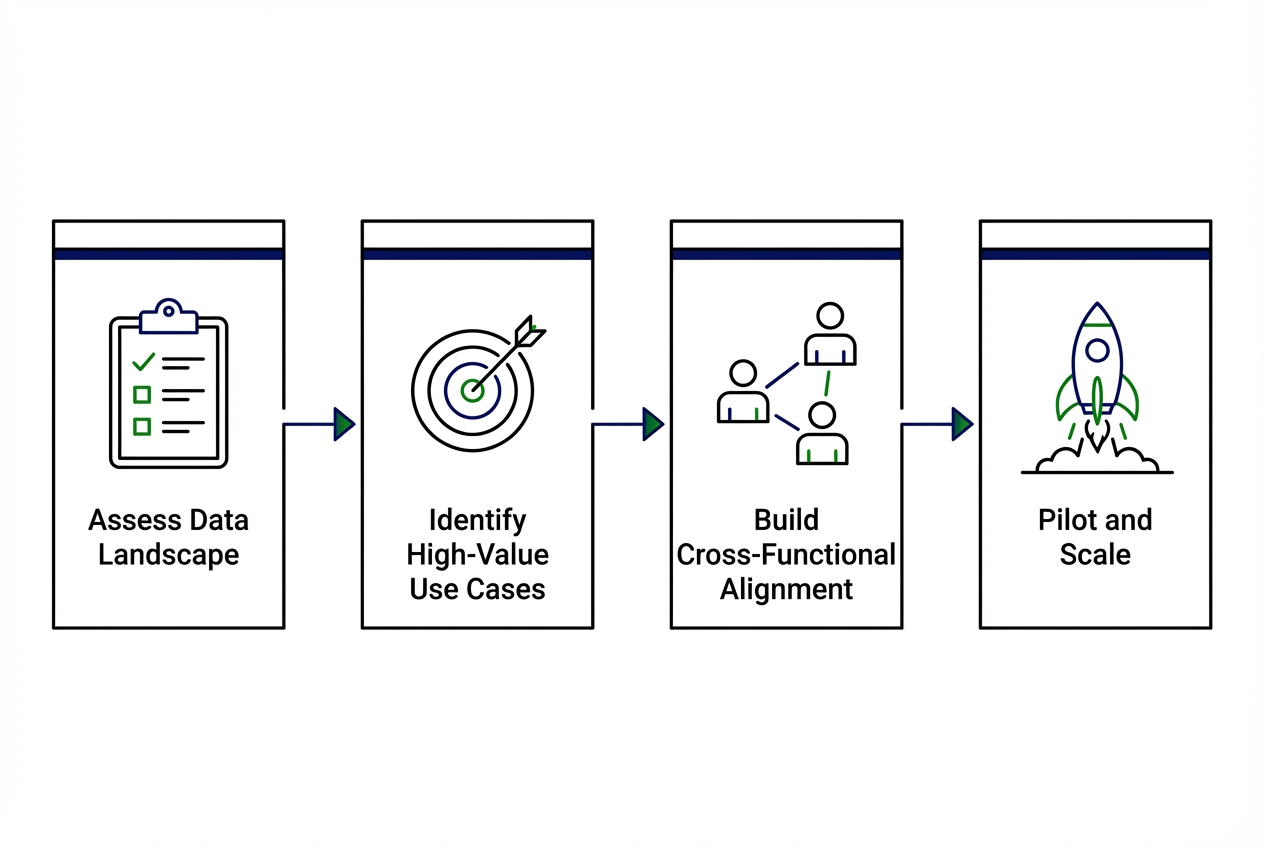

_\[CAPTION: Four-step implementation roadmap for agentic analytics in pharma market access\]_

Ready to move forward? Here's a practical roadmap.

### 1\. Assess your current data landscape

Inventory existing data assets—payer contracts, pricing databases, claims feeds, competitive intelligence subscriptions. Identify gaps and integration challenges. Determine whether a semantic layer exists to unify definitions across sources.

### 2\. Identify high-value market access use cases

Prioritize use cases with clear ROI. GTN visibility, competitive monitoring, and formulary tracking are common starting points. Start where data is relatively clean and business impact is measurable.

### 3\. Build cross-functional alignment

Agentic analytics touches pricing, market access, commercial operations, and finance. Stakeholders agree on data definitions, success metrics, and governance. Involving IT and data teams early prevents downstream friction.

### 4\. Start with a pilot and scale

Begin with a focused pilot—one product, one therapeutic area, or one payer segment. Validate accuracy and business value before expanding. Document lessons learned to accelerate rollout.

---

## How agentic analytics fits into your market access tech stack

Market access teams already use multiple tools. Agentic analytics complements rather than replaces existing investments.

Key integration points include data warehouses and lakes (Snowflake, Databricks, Redshift), pricing and contract management systems (Model N, Revitas, or custom contract databases), competitive intelligence feeds (IQVIA, Evaluate Pharma, SSR Health), and BI and visualization tools (complementing Tableau and Power BI dashboards with conversational analytics).

The goal isn't to rip and replace—it's to add an intelligence layer that makes existing investments more valuable.

---

## Accelerate market access decisions with agentic analytics

Market access teams that adopt agentic analytics shift from firefighting to strategic planning. The technology exists today to move from weeks-long analysis cycles to real-time answers.

Early adopters gain competitive advantage in payer negotiations and pricing decisions. They respond faster to competitive moves, identify access barriers before they impact revenue, and optimize GTN with greater precision.

[Request a demo to see Tellius in action](https://www.tellius.com/demo)

---

## FAQs about agentic analytics for pharma market access

### How long does it take to implement agentic analytics for market access?

Implementation timelines vary based on data readiness, but most pharma organizations deploy initial use cases within weeks if data infrastructure exists. Complex integrations across multiple pricing and payer systems may extend timelines to a few months.

### What data sources do AI agents require for pharma market access analytics?

AI agents for market access typically require payer contract data, pricing master files, claims or prescription data, formulary databases, and competitive intelligence feeds. The more sources connected, the more comprehensive the insights.

### Can AI agents handle regional pricing variations and country-specific regulations?

Yes, agentic analytics platforms can be configured to account for regional pricing rules, international reference pricing, and country-specific reimbursement requirements. The semantic layer ensures queries return market-appropriate results based on user context.

### How do agentic analytics platforms ensure compliance with pharma pricing regulations?

Agentic platforms maintain audit trails of all queries, data sources, and AI-generated insights to support compliance requirements. Role-based access controls and data governance policies ensure sensitive pricing information is only accessible to authorized users.

### What is the difference between agentic analytics and traditional BI tools for pharma market access?

Traditional BI tools require users to build dashboards and manually investigate data; agentic analytics platforms proactively surface insights, answer natural language questions, and automate routine analysis. AI agents continuously monitor data and alert users to changes rather than waiting for someone to ask.

Get release updates delivered straight to your inbox.

No spam—we hate it as much as you do!

No items found.

No items found.